Reliance Steel and Aluminum Co. (RSAC) , is the largest metals service center operator in North America and is headquartered in Los Angeles, California. The company provides metals processing services and distributes a line of approximately 50,000 metal products, including aluminum, brass, alloy, copper, carbon steel, stainless steel, titanium, and specialty metal products to fabricators, manufacturers, and other end users.

The company is a member of the Fortune 500.

Maps, Directions, and Place Reviews

Current operations

Principal Brand Names

Principal Brand Names are Allegheny Steel Distributors, Aluminum & Stainless, American Metals/Steel, AMI Metals, Best Manufacturing, Bralco, CCC Steel, Chapel Steel, Chatham Steel, Clayton Metals, Continental Alloys, CPS, Crest Steel, Delta Steel, Diamond Manufacturing, Durrett Sheppard, EMJ, Feralloy, Fox Metals, Infra-Metals Co., Liebovich, Metals USA, Metalweb, National Specialty Alloys, Northern Illinois Steel, Pacific Metal, PDM Steel, Phoenix Metals, Precision Flamecutting, Precision Strip, Reliance Metalcenter, Siskin Steel, Service Steel Aerospace, Sugar Steel, Sunbelt Steel, Tube Service, Tubular Steel, Valex, Viking Materials, Yarde Metals, Alaska Steel Company.

Management

- Gregg J. Mollins, President & Chief Executive Officer

- Karla R. Lewis, Senior Executive Vice President & Chief Financial Officer

- James D. Hoffman, Executive Vice President & Chief Operating Officer

- William K. Sales, Jr., Executive Vice President, Operations

- Stephen P. Koch, Senior Vice President, Operations

- Michael P. Shanley, Senior Vice President, Operations

- William A. Smith II, Senior Vice President, General Counsel & Corporate Secretary

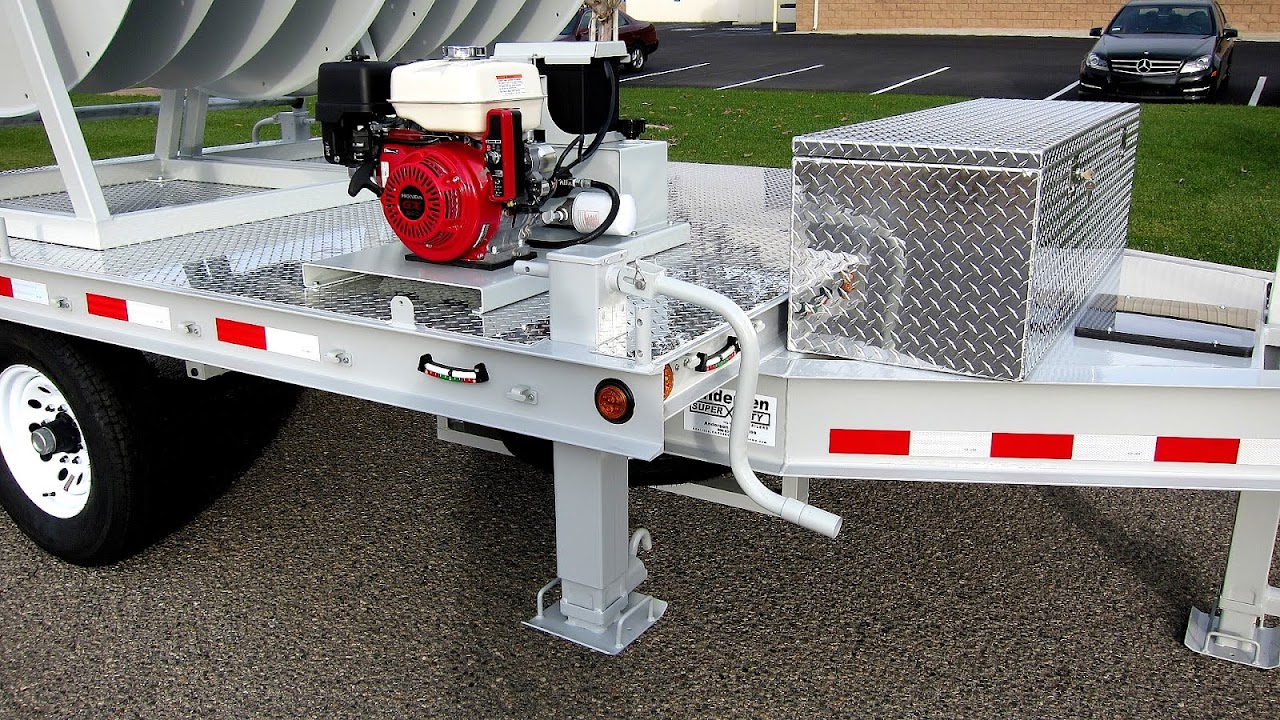

Hagerty Steel Video

History

Reliance Steel & Aluminum Company was founded in Los Angeles on February 3, 1939 by Thomas J. Neilan. Originally named Reliance Steel Products Company, the business made and sold steel reinforcing bars (rebar) for the construction industry. In 1944, the name was shortened to Reliance Steel Company.

In 1948, Reliance Steel also began manufacturing products of aluminum and magnesium. As William T. Gimbel, Neilan's nephew who joined the company as a trainee in 1947, later told Metal Service News, "We started out (in 1939) with the dirty, old, down-in-the-gutter carbon steel, but that became a world commodity. So we decided that we wanted to upgrade into something that had a little bit more pizzazz, and we picked aluminum and magnesium."

Gimbel, who started as a warehouse man, succeeded Neilan in 1957 as president of the company, a year after its name was changed to Reliance Steel & Aluminum Company. Under Gimbel, Reliance began its long-running territorial expansion, naming a resident sales agent in Phoenix in 1958. Two years later, Reliance acquired a small Phoenix-based competitor, the Effron Steel Company. With the purchase of another competitor, the Westates Steel Company, in Santa Clara, Reliance Steel expanded into Northern California in 1961.

In 1963, Reliance continued its growth through acquisition by purchasing the Drake Steel Supply Company, which operated metals service centers in Fresno and San Diego, California. With the purchase, Reliance also acquired the services of Joe D. Crider, who had joined Drake in 1949 as a billing clerk and worked his way up to Fresno sales manager. After several years as manager of Reliance Steel's Los Angeles division, Crider was named executive vice-president in 1975, teaming up with Gimbel to form what Metal Service News would later call "perhaps the best known management team in the service center industry."

In 1966, Reliance extended its reach into Texas by acquiring metals service centers in Dallas and San Antonio from Delta Metals, Inc. Two years later, the company bought out another Los Angeles competitor, the Catalina Steel Company, its fifth acquisition in ten years. By then, Reliance Steel had also established SupraCote, a coil-coating division, in Cucamonga, California. It became a separate subsidiary in 1973, and was sold to a management group in 1980.

Reliance Steel acquired Southern Equipment & Supply Company, San Diego's oldest metals service center, in 1972, and immediately launched a $1.8 million project to double the size of the San Diego facility. Two years later, the rapidly growing company announced a $4 million expansion in Los Angeles.

Reliance Steel also wanted to strengthen its position in Texas, and, after attempting to acquire a Houston business, temporarily abandoned its acquisition philosophy and opened a new metals service center in Houston in 1975. Gimbel told Metal Service News, "We had spent probably two years trying to buy out somebody, but at the time there was a big boom there, and everyone felt the streets of Houston were paved with gold. We just could never make a deal to buy someone. So we started our own company." Reliance closed the Houston center in 1984 due to a slump in the oil industry.

In 1980, SupraCote coil-coating subsidiary is sold to management.

Reliance ventured into the eastern part of the United States for the first time in 1975 when it acquired the Purchased Steel Products Company, in Atlanta. The move never panned out, however, and Reliance sold the center in 1987. Gimbel told Metal Center News, "We learned a lesson in Atlanta. If we're going to go further east, that probably means the Chicago area. And you don't move into Chicago on a shoestring."

After more than three decades of operating full-service metals service centers, Reliance opened its first "specialty store" in 1976, forming the Tube Service Company, in Santa Fe Springs, California. The subsidiary specialized in tubular products. A second Tube Service opened three years later in Milpitas, California. In 1977, Reliance also acquired Bralco Metals, in Pico Rivera, California, which specialized in brass, aluminum, and copper. To manage its aluminum, magnesium, and stainless steel products, Reliance created a nonferrous metals division, Reliance Metalcenter, in 1980.

In 1994, after 55 years as a closely held operation, Reliance issued its first public stock. At the time, the company had about 180 stockholders, most of them employees or relatives of founder Thomas J. Neilan. Reliance had previously considered, and rejected, going public several times. In 1984, Gimbel told Metal Service News, "We'd go and talk to the brokers, but, unfortunately, anything with the name steel in it didn't get them very excited." In its prospectus, Reliance also signaled its intention to continue growth through acquisitions, stating, "Traditionally, metals service centers have been small, family-owned businesses that lack the diversity of experience and successful operating techniques of Reliance and thus have and may in the future become candidates for acquisition or consolidation.

Crider, who became chairman in early 1997, succeeding Gimbel, who remained on the board of directors as chairman emeritus, said in interviews that he expected Reliance Steel to continue growing through acquisitions. Industry analysts expected Reliance to focus its expansion on the strengthening Midwest market.

A secondary public offering in November 1997 raised $94 million to fuel further acquisitions. A $150 million private placement followed a year later.

Company president David Hannah succeeded Joe D. Crider as CEO in February 1999. Crider remained chairman. Chairman emeritus William T. Gimbel had died in December 1998.

The company's Valex unit dominated the U.S. market for electropolished stainless steel tubing and fittings used to build semiconductor plants. Expanding overseas, in 1999 Valex opened a distribution center in France and formed a manufacturing joint venture in Korea. Valex shut down its Phoenix distribution site in 2003.

RSAC Management Corp. was formed as a holding company in 1999. The corporation also performed administrative and management tasks for the metals service centers. Reliance ended the decade with sales of nearly $1.6 billion a year.

The U.S. government imposed tariffs on imported steel in early 2002. This made the price of hot-rolled carbon steel rise and Reliance's shares fall, observed the Los Angeles Business Journal. The tariffs were lifted in December 2003 after complaints by U.S. automakers.

Subsidiary AMI Metals, Inc. opened a European business in January 2003. Based in Gosselies, Belgium, AMI Metals Europe, SPRL focused on the aerospace industry. AMI closed its Atlanta area facility during the year while opening a new on in St. Louis.

Acquisitions history

Reliance grew from a single metals-processing center in Los Angeles into a major corporation by acquiring dozens of competitors. In an interview with an industry publication in 1992, Joe D. Crider, then president and chief operating officer, explained, "You can pay the bill [for higher market share] through price cutting, or through paying goodwill to buy a competitor. In cutting prices, you often trash the marketplace. So over time, the latter route is usually the less expensive, as long as you buy at a reasonable price."

In 1960, Effron Steel is acquired. In 1961, Northern California's Westates Steel is acquired. In 1963, Drake Steel Supply is acquired. In 1966, Texas metals service centers are bought from Delta Metals, Inc. In 1968, Catalina Steel is acquired. In 1972, Southern Equipment & Supply metals service center is acquired and expanded. In 1977, Bralco Metals is acquired.

In 1980, Reliance also acquired Foucar, Ray & Simon, a specialty tube distributor in Hayward, California, with a branch in Portland, Oregon. The Hayward center was eventually merged into the Reliance center in Santa Clara. The Portland operation foundered and then closed in 1984. Gimbel told Metal Service News the acquisition had been a mistake. "Foucar was probably the second oldest service center in California, with a good reputation. They'd done well over the years, but I guess they'd gotten rigor mortis. We thought that we could change all that. We tried and tried to change it, and it didn't work. So we had to admit defeat and close up the place."

In 1981, Reliance purchased the Cd'A Service Center in Salt Lake City, Utah, from Spokane-based Cd'A Steel Service Center. The company then acquired Circle Metals in Carson, California, in 1983, and Tricon Steel & Aluminum in Fremont, California, and Arnold Engineering in Fullerton, California, in 1984. Arnold Engineering was renamed Arnold Technologies, Inc. and relocated to Anaheim.

In 1985, Reliance acquired Ducommum Metals in Phoenix and Los Angeles, the Lafayette Metal Service Corp. in Long Beach, California, and the assets of the Livermore, California, metals service center from Capitol Metals Company.

The company also acquired the Valex Corporation in Ventura, California, which made stainless steel components for electronic and pharmaceutical applications, the Dallas/Fort Worth Russell Steel Division of the Van Pelt Corp., and the Morris Steel & Aluminum Company in Albuquerque, New Mexico. In 1988, Reliance also acquired the Los Angeles Sheet & Steel Division from Earle M. Jorgensen Company.

Over the next two years, it acquired the assets of Albuquerque, New Mexico-based Smith Pipe & Steel and the Los Angeles and Phoenix operations of Lusk Metals.

Other acquisitions in the 1990s included Affiliated Metals, an aluminum and stainless steel specialty center in Salt Lake City, Utah, and the Wichita, Kansas, operations of National Steel Service Center Inc., which stocked aluminum plate, sheet, and coil for the aerospace industry. The National Steel acquisition marked Reliance Steel's first foray into the Midwest.

In 1995, Reliance acquired a 50% interest in American Steel, L.L.C. for $19 million. (This shareholding was raised to 50.5 percent in May 2002).

In 1996, the company acquired VMI Corporation, an 11-year-old nonferrous metals service center in Albuquerque, New Mexico, and CCC Steel, Inc., which operated carbon-steel service centers in Los Angeles and Salt Lake City.

Reliance also announced the acquisition of the Siskin Steel & Supply Company, Inc., with metals service centers in Chattanooga and Nashville, Tennessee; Spartanburg, South Carolina; and Birmingham, Alabama. Reliance Steel paid $71 million for the company, which had revenues of $151 million and would operate as a wholly owned subsidiary.

In 1997, the company acquired Amalco Metals, Inc., a metals service center company in Union City, California, that specialized in processing and distributing aluminum plate and sheet, and AMI Metals, Inc., a Brentwood, Tennessee, company that specialized in processing and distributing aluminum plate, sheet, and bar products for the aerospace industry. AMI operated service centers in Fontana, California; Wichita, Kansas; Brentwood, Tennessee; Fort Worth, Texas; Kent, Washington; and Swedesboro, New Jersey.

Reliance acquired Service Steel Aerospace Corp. of Tacoma, Washington, in October 1997.

Reliance bought Phoenix Metals of Atlanta for $21 million in January 1998. It had sales of $120 million a year.

The company acquired a smaller Atlanta company, Georgia Steel Supply, around the same time. Georgia supply had revenues of $22 million a year.

Other 1998 acquisitions included Baltimore's Durrett Sheppard Steel Company (with annual sales of $47 million), Chatham Steel Corporation, Lusk Metals, Engbar Pipe & Steel Company, and Steel Bar Corporation.

Reliance also reached an agreement to buy 50% of American Metals Corporation of West Sacramento, California, which was formerly part of the American Steel joint venture with Portland-based American Industries.

Liebovich Bros. Inc., a Rockford, Illinois, supplier of carbon steel products, was acquired in March 1999. It had sales of $130 million. Other 1999 acquisitions included Allegheny Steel Distributors Inc., Dallas-area aluminum distributor Arrow Metals, and Hagerty Steel of Illinois. Pennsylvania's Toma Metals Inc., a small specialty stainless supplier, was added in 2000 and divested in 2018.

Reliance bought United Alloys Inc.'s aerospace division in August 2000. Founded in 1971, it had sales of $18 million a year. The acquisition added titanium products to Reliance's lineup.

Viking Materials Inc., a Minneapolis-based processor and distributor of flat-rolled carbon steel products, was bought in early 2001. Viking had been formed in 1973 and had 1999 revenues of $83 million as well as 155 employees and facilities in Illinois and Iowa.

Reliance was also adding to its operations in the South. East Tennessee Steel Supply Inc. was added to Reliance's Chattanooga-based Siskin Steel unit in early 2001. It had revenues of $6.6 million in its 2000 fiscal year.

Pitt Des Moines Inc. (PDM) was purchased for $97.5 million in the summer of 2001. Pitt had sales of $260 million a year at seven locations, most in the West.

Reliance acquired assets of Central Plains Steel Company in April 2002. Based in Kansas, the business had net sales of about $27 million in 2003. Denver metals service center Olympic Metals, Inc. was acquired at the same time. Olympic specialized in aluminum, copper, brass, and stainless steel and had sales of $7 million in 2003.

Certain assets of a unit of bankrupt Metals USA, Inc. were purchased in September 2002 for $30 million. The unit subsequently began operating under its original name, Pacific Metal Company. Its sales were $70 million in 2003.

Acquisitions (2003-present)

Source of the article : Wikipedia

EmoticonEmoticon